Your one-time offer

Taking a Wind-Up Lump Sum from the RSP Section.

What is a Wind-Up Lump Sum?

A Wind-Up Lump Sum (WULS) offer provides eligible members with a one-time opportunity to take their benefits from the RSP Section now, at its current cash value, rather than waiting to take their benefits at Normal Retirement Age of 65.

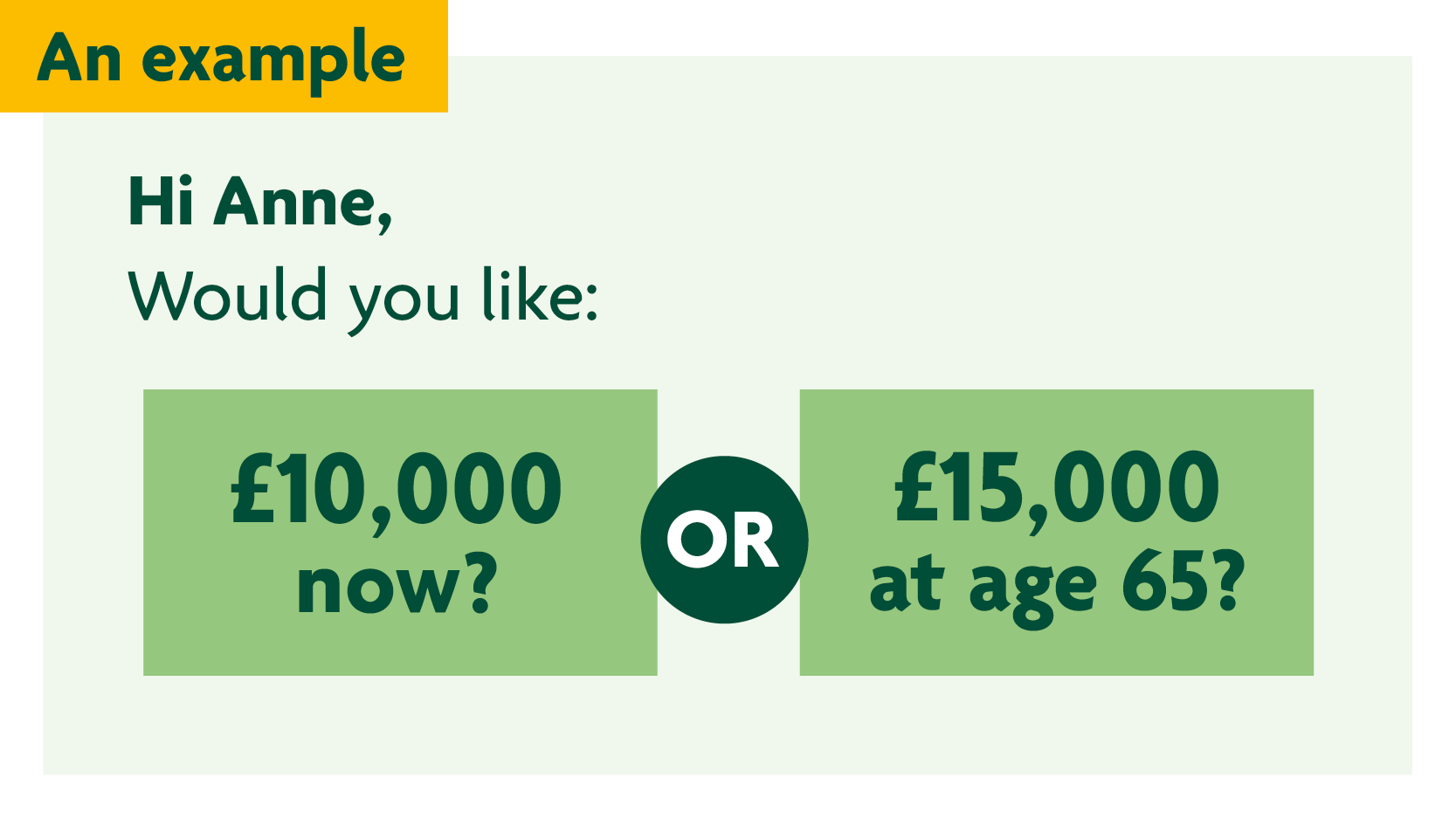

This example is to illustrate the potential choice a member might have.

All values are individual to each member and is likely to vary significantly from person to person.

Who is eligible for the offer?

Eligibility for the offer of a WULS payment is based on the total value of a members’ benefit at the point the offer is made.

To be eligible for a WULS offer, the total value of your RSP Section benefits must be £18,000 or less at the point of offer.

There is no age limit on who can take up the offer, or who is eligible for the offer, however anyone who is aged 80 or over during the exercise will be communicated with separately and outside of this exercise.

When will I receive my offer?

If you are eligible for an offer – which we believe you are likely to be – you will receive a letter from Aon, who has been appointed by the Trustee to run the WULS exercise, between the end of May 2025 and the end of September 2025, which will include your personal WULS offer. Your letter will include:

- Your one-off cash sum offer – this is the amount you can receive as an immediate cash sum before income tax, if you choose to take your benefits from and leave the RSP Section.

- Your retirement lump sum amount – this is the estimated amount you will receive at Normal Retirement Age (age 65) before income tax, if you opt to keep your benefits in the RSP section.

How long do I have to consider my offer?

Your offer will be valid for at least 8-weeks from the point of offer. The date the offer expires will be included on your offer letter and will be the deadline for you to accept the offer. You will need to let Aon know no later than the deadline date to guarantee payment.

Please use this time to consider your options carefully and take financial advice, if you want to.

Will the WULS offer be made again at a later time?

No, this is a one-time offer from the Trustee as the RSP Section plans to wind-up. It is therefore not possible to make this offer again in the future.

Can I opt-out of receiving my offer?

If you don’t want to receive your offer, you can opt out if you want to. You’ll have to let Aon know before Thursday 14th May by completing the form that was included in the pack you received in April.

You can:

1. Scan or photograph the completed opt-out form and email it to it to:

MRSP-WULS-OptOut@aon.com

OR

2. You can return the completed opt-out form by post to:

MRSP WULS Opt Out, 3 The Embankment, Sovereign Street, Leeds, LS1 4BJ

Remember: even if you receive your offer, you do not have to accept it.

If you are unsure whether you want to receive your offer, we recommend that you don’t opt out.

If you receive your offer, you can make an informed decision as to whether you would like to accept it or not, once you have all the information available to you.

If you haven’t received your offer by the end of September.

To be eligible for a WULS offer the value of your RSP Section benefits needs to be £18,000 or less at the point the offer is calculated. If your value changes and exceeds the eligibility criteria during the process, you won’t be sent an offer.

Taking Financial Advice

You don’t have to make a decision alone

You may find this an easy decision to make, or you may be wondering what the right thing for you to do is.

If you are unsure, we always recommend taking financial advice when it comes to making decisions about your money. Financial Advisers do charge for their services, but they can provide advice based on your individual circumstances and financial situation, which can help you make the decision that’s right for you.

You can find a list of Retirement Advisers through MoneyHelper. They can help you with financial decisions when you’re building your retirement savings, or when you are looking to take your pension.

Remember: all advisers must be regulated by the Financial Conduct Authority (FCA) and you should always check the Financial Services Register.